Controlling my financial (in action)

My major new year resolutions for this year mostly related to manage my financial better. I guess I shouldn’t be shy to confess that I’m a very bad credit card user. I spend really a lot, where most of my cards are ‘max’ out. I still remember first very first attempt to clear my debts 2 years ago – well, it not going well at all.

But it’s pretty clear to me that credit card is the major element that makes my not having a full control of my finance, so the only thing to combat this is get rid of it totally.

Have you heard of the terms “debt consolidating”? Well, this is really famous long time ago in UK (when I was still studying). On a surface, debt consolidating means that combining all of your debts (loans, mortgage, credit card, etc) in one account, and you only have to make 1 payment. When this terms tick in my mind recently, after the search around, I just find the right product for this – Quick Cash Edge from Standard Chartered.

I gave them a call, and stating what is my intention. The agent ask me – do you want to take the money, or do you want us to clear your credit card? The later sounds better. Let them deal with everything. I started to have devil’s tail when having a huge amount of money in my hand.

But I really suprise with the simplicity of the process. After the call, the agent fax me the application form. I fax back the signed application form, together with the latest statement of my credit card that I want to settle, as well as other documents (photocopy of IC, 3 months pay slip and EA form). The agent called me back after receiving the form and documents, and agree on the amount that I want to loan.

The approval supposed to be 24 hours, but the agent apologize that I might take a week since they received quite a lot of application forms, and many public holiday are around (New Year, Awal Muharram).

A week later, the agent called me and say that my loan has been approved, and the cheque has been sent out to my credit card banks, and the letter about this also arrived the day after. Also I can come to the bank anytime to withdraw the balance of the money from my loan. Wow. That’s good. No going to lawyer firm to sign agreement beforehand.

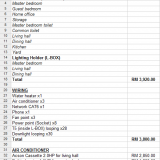

So went to Standard Chartered Bank today. When agreeing the amount that I want to loan the other day, I actually ask for some cash as well. Hehe. Well, it’t the agent’s fault since he said “Sir. Take some money lar. If you borrow RMXX,XXX and above, you’ll get the lowest interest rate)”. Hhhmm. Why not.

But one’s will say, what’s the point of making a new debt, just to cover the existing debt? But I don’t see it this way here. I’m pretty sure most of the people will face what I’m facing – no matter how many times we pay our credit card, but we are still far off from paying the whole thing. That’s the problem with credit card. After you pay, you will keep using it + interest = it’s a never ending story.

So, this “debt consolidation” helps you in a way that, it will accumulate all of your debts into one account (in my case credit card), and pay everything in one lump sum. Now, I can close my credit card. Since this is a loan, what you pay back monthly is something that you can’t use anymore. Eventually as time goes, you will settle with the loan payment.

Also, since we are consolidating everything in one account, there is only 1 monthly payment that you will need to do, and it’s cheaper from the my previous monthly credit card payment combined. Believe me, there is RM1000 different compared to my monthly credit card payment previously. And I found this help me, financially, a lot.

imran kejap ye.. sefaham syia..maksudnye ambik loan kat bank lain.. lepastu.. gunekna duit loan tu bayar segale2 hutang lepastu kirenye kite berhutang dgn pihak yg bagi loan tu je kn?

Ini serupa dgn AKPK yang ditubuhkan oleh Bank Negara untuk mereka yang mengalami masalah kawalan kredit.

Maklumat lanjut boleh didapati di sini http://www.akpk.org.my/index_bm.htm

haha.. I also will receive loan from my company this march.. willing to solve all my credit card’s debt and hope the instalment not much more as before.. 🙂

Good to see some one actually getting out of credit card debt. I haven’t been good either managing my HSBC credit card. I hope this year will be different.

US college card deals are the worst! It took me 5 years to pay off my college debts. Most students are too ignorant about money to use a credit card. At least i was…