2009 Income Tax return

My HR Manager pass me the pay slip of this month salary together with the EA Form. First thing that came to my mind – oh not. It’s that time again. The same thing that I always say year after year, this is the time that you will see your hard-earned money has to be given back to government.

Well, decided to be a good citizen this time, I’m going to file my Income Tax return early this year, just to beat the traffic. Believe me, the LHDN’s e-Filing website can be really congested when the deadline for the form return is nearer.

But before I can do so, let’s dig all the expenses that entitled for tax relief from last year. Ahh. That’s my 2009 Bills file.

I do have a section for Tax in my file, just to keep all the receipts of transaction that I can use to for deduction claim later on. Believe me. If you don’t file it this way, it’s very hard to find all the receipts that you spend for 1 whole year if you tried to consolidate it during the last minute.

I have all the receipts for my magazines and books purchase,

and do you know that puchase of personal computer for individual can be exempted from income tax every 3 years? I happened to buy one last year, and kept the invoice for this too.

I’m ready now to start filing my income tax form. The website to visit is https://e.hasil.gov.my/. Since I use this in the past, I have my account here already. If you are using this for the first time, you will need to obtain PIN number for the digital certificate registration. I believe the PIN number will be printed on the hardcopy of BE Form that is mailed to you.

Now you need to choose which form that you want to use. Since I don’t have business income, and I’m resident. I will need to use e-BE form.

And then I login using my NRIC number and password that I have set up.

Once you logged in, the very first thing that you need to do is to provide your individual particulars. Some of the fields should already be auto-filled for you. Noticed the Bank Account No field?

When this field was first added to the income form tax, there was a representative from LHDN that came to my office to give briefing on the new form. Someone did ask why that Bank Account No field is there. Well, the answer is, if you have tax paid in excess, it will be reimbursed into your saving account. Well, not quite. It’s been so many years already, and they still send cheque for tax pain in excess that takes several months before you receive it.

Anyhow, once you finished with your individual particular, the next part is where you will declare all of your income. Well, my only income is from the from the salary that I got from my job. Sad isn’t it. The amount to be filled in at Penggajian field is to be taken from the amount showed in the EA form that I received.

When I list out all of my income, the total my income will be displayed at JUMLAH PENDAPATAN (SENDIRI) field. Then, I need to fill in the tax deduction for my salary that I have paid. This is again is shown in the EA form.

In the next part, I need to declare any past income that haven’t been declared before. Turned out that the special management bonus that I received in 2008 hasn’t been declared before. So I have to put here. And the tax deduction has been paid for this, but there’s such field here to put that information. I kinda wondering how they will treat this. Hhhmm..

The next part is the most important. Here is where you need to list out all the deduction claim that you want to make, and you have to understand each single item, so that you can do the necessary tax exemption if you are eligible. In other words, if you spend your salary for things that is entitled for tax relief, you don’t have to pay tax for those money that you spend.

This part is always the same to me each and every year. Remember the receipt digging that I did at the earlier of this blog? I just put the amount that I spend on books and magazines, and this time, I also bought a new computer for myself.

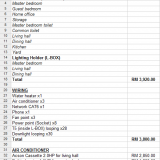

There’s something new here too – Faedah pinjaman perumahan. Well, I just bought house recently. But there’s something fishy about (mesti memenuhi syarat-syarat kelayakan) clause. I wonder what the conditions will be.

And this is something that I found from Buku Panduan BE 2009.

Darn. I guess I’m not eligible for this as I signed the SPA sometimes in November 2008.

Child Deductions are something that is never applicable for me (LOL). And the last item for my deduction claim will be Insurans nyawa dan KWSP. “Caruman KWSP” is something that can be found from EA form also, and mine one always exceed RM6000 every year, therefore I can only claim to the max of RM6000.

The next part is the last part that you can further do claim/deduction/relief. The only item that is applicable for me is Zakat atau fitrah. This is already some form of deduction that is done to your income, therefore, it should be exluded from the calculation of your income tax.

Once you’ve done with declaring your income, and listing out the deduction that can be made, the next page will show you the summary of all of these. Taking out total relief from the total income, you will get the amount of income that is chargeable for the tax. There’s this table of the chargeable income range of the rate of the tax that will be charged.

Well, if you are using e-Filing, you don’t have to worry about the calculation as this is done automatically. From this, you will get the total of income tax that you need to pay, based on your income. Further tax rebate that you declare will be deducted from your total income tax, and the CUKAI KENA DIBAYAR is the amount that you have to pay.

If the tax is already deducted from your salary via PCB (Potongan Cukai Berjadual), the amount will be deducted from the tax payable. And the outcome of this is whether you have BAKI CUKAI KENA DIBAYAR (balance of tax payable) or CUKAI TERLEBIH BAYAR (tax paid in excess).

Hello there. I have tax pain in excess for this year ![]()

I have to do income tax every year but for personal computer I can use its reciept for reduce the tax 🙁 or I misunderstand?

ahhh…the time again..bossan…

yeah. i perfectly understand that feeling. hehe

Do anyone know where is broadband tax rebate applicable?

Hi Max. Basically that's why I thought at first. But I don't see any item of that nature in the current BE form 🙁

kalau tak silap, kalau jumlah pendapatan (gaji bulanan ngan elaun) lebih dari RM2500 sebulan, dah start kena cukai dah. kalau keje kerajaan, tak tahu camner mechanism dia. tapi klu keje swasta, biasanya majikan akan arrange PCB (potongan cukai berjadual) kalau kita dah kena bayar tax. maknanya dlm pay slip tiap2 bulan, dia ada potong atas nama ITAX.

agak2 boleh dapat tak 1k++ tu ahaks

klu terlebih bayar, dorang for sure akan kasi balik. cuma lambat atau cepat je. kekadang kena tunggu 6 bulan utk dptkan balik. huhu

Great post! Thanks very much.

Btw, the broadband tax is only applicable for 2010 Taxes—which means we get the relief when we do our taxes next year!

tnx Elaine. ahh… good to hear that. more things to be exempted from the tax calculation 😉

great post! if only i had this reference 4 years ago when i had to do my 1st income tax LOL

btw, regarding the 'past income' which hasn't been declared, it happened to me as well last time, no field to put in the PCB amount that you've already paid. I found out later that the Income Tax ppl will manually re-calculate your details for that year & they'll give you a call..in my case, i had to pay additional for that year, so maybe that's why they called me up…not sure how it'd be if it was the other way round tho :p

tnx. i guess 4 years ago i'm strugling with using the e-Filing.

about the past income that hasn't been declared, i will just wait and see to see what they will do to it 😉

time to fill up.. 🙂